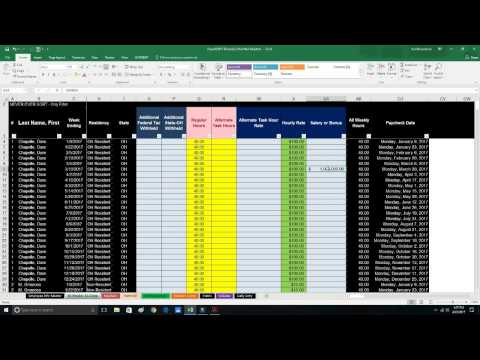

Hello there everyone. I know you're probably happy to think about tax season being over. It's April 22nd, and I mean, you know, I followed my federal return. Maybe you have a state one, but let's do a little later because the states are due after April 15th. 30 days to be exact. So this year, well, you might think everything's great, but there's Form 941 to be filed. Are you a business owner? Do you have small business payroll taxes? I'm going to help you out right now. This is a 2017 payroll in Excel version. Your bi-weekly version. We're going to go over how to automatically generate the numbers for Form 941 so that you can fill it out and send it off. So this is the beast that you have to deal with. You have to deal with Form 941. We're in 2017, probably Q1. You're looking at it right now because it's due on May 1st. It's usually due about 30 days after the end of the quarter. So you have to fill out this information, but let's not worry about the details of your personal company. Let's talk about the numbers. So there are numbers. How many employees? What were their wages? And what's the difference between this number and what's taxable? What's a Social Security wage? What's a taxable Medicare wage? Is there this additional Medicare withholding if they make over $200,000 a year? So if they make over $200,000, there's something called additional Medicare withholding. I believe that's still there on the 2017 form. I think the Republicans want to get rid of it eventually, but it's still there for now. And no, there's no need to worry about it. So what are your taxes? What did you pay? You have to fill...

Award-winning PDF software

Video instructions and help with filling out and completing Which Form 944 Pr Payroll