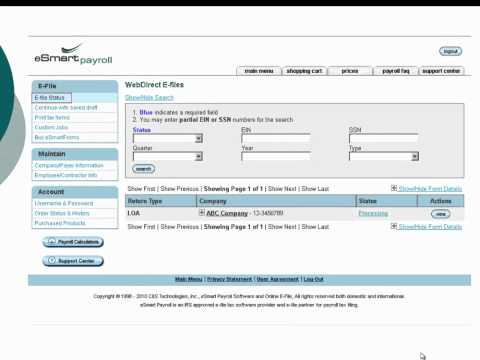

Traditionally, filers used to prepare forms 941, 940, or 944 on paper, sign, and mail the documents to the IRS. Now, you can simply efile the forms. With this option, you are required to provide an e5 PIN, which can be either a 10-digit or 5-digit number. These digits are recognized by the IRS and, just like a signature on a paper form, they verify the responsible party preparing the return. It's important to note that the e-file PIN and the 4-digit EFTPS PIN are not the same thing. They are two separate PINs and cannot be used interchangeably. As mentioned earlier, the e-file PIN can be either 10 digits or 5 digits, depending on your filing status. If you are filing 94X for your own company, you will need the 10-digit PIN. If you are filing on behalf of a client, you will have the choice of either using your client's 10-digit PIN or using your own 5-digit number. Once you know which PIN you need, you can proceed to apply for one with Smart Payroll. Not only can users efile forms, but they can also apply for a 10-digit PIN for free. Under the main menu, choose the option "PIN Application for 94X" and click "Apply". Fill in the required information and add your application to the shopping cart for checkout. It's important to remember that the application is free of charge. After finishing the application, you will receive an order number for your submission. You can review the application by going to "e-file status" on the left-hand menu. Smart Payroll will send the application to the IRS for review, and the entire process may take around two weeks. Once the application is approved, the IRS will mail you a letter containing the e-file PIN, along with an acknowledgement receipt. You will need...

Award-winning PDF software

Video instructions and help with filling out and completing When Form 944 Pr Isnt