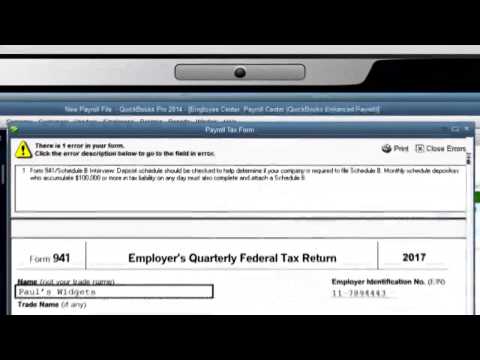

Hey, I'm Paul Hockman. Four into it? Yes, QuickBooks Payroll makes doing your payroll fast and easy. But how about e-filing and paying payroll taxes? Well, QuickBooks Payroll makes that easy too. Okay, let's go to Payroll Center, select the Tax Forms tab, and pick the form you want to run. Choose Form 941 to file your quarterly payroll taxes. Click OK, and in seconds, QuickBooks Payroll fills out the form and then displays it for you to review. Just click the check for errors button, and if there are problems, they'll be displayed at the top field. Now click Submit form and then print hard copies for your records. Also, click efile, enter your 10-digit EFTPS and business info in a check, remember the information for next time, and click Submit. Done! Your filings are zipping at Lightspeed over the Internet to the IRS. You can do the same thing with most state forms and payments. Now you're in business. I'm Paul Hoffman, four into it.

Award-winning PDF software

Video instructions and help with filling out and completing How Form 944 Pr Payments