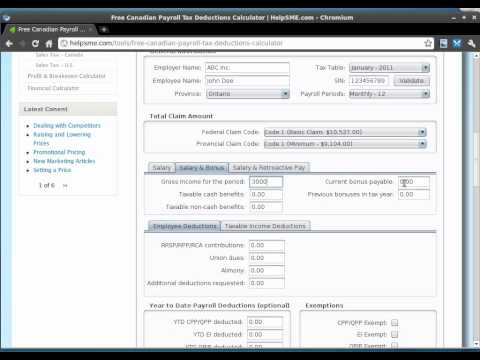

Hello and welcome to the screencast. My name is Kareem Refet with help SME comm. Here, we'll cover calculating Canadian payroll taxes with a help SME calculator. To access it, visit help SME comm and go to the free tools payroll Canadian payroll calculator. Once on this page, you'll notice there's a download rate version available here on the right-hand side that you can freely download and use. If we scroll down a bit, we can access the online version on the top under general information. If we want the employer name to be printed out on the report, we can enter it here. We'll just say ABC Inc. If we want the employee name on the report as well, we can enter it here. Let's say John Doe. And for our example, we'll say John Doe resides in Ontario. The government adjusts tax rates, claim amounts, and so on every six months. They publish new data. So under the tax table, pick the month that corresponds to the pay date. So the January 2011 selection here covers salaries from January to July 2011. So we'll leave it at January 2011. If you'd like to validate a social insurance number provided by the employee, you can do that here. Just enter it in and click validate. And here, we choose how many payroll periods used per year. In our case, for this example, let's say monthly. Under total claim amount, we use the claim code for the employee. The basic claim for residence is claim code 1, so we'll leave it at that. If your employee has filled out the td1 form and requested a different claim code, you just select it from the drop-down list. Note that the claim code corresponds to the province selected. So, if you change...

Award-winning PDF software

Video instructions and help with filling out and completing How Form 944 Pr Deduction