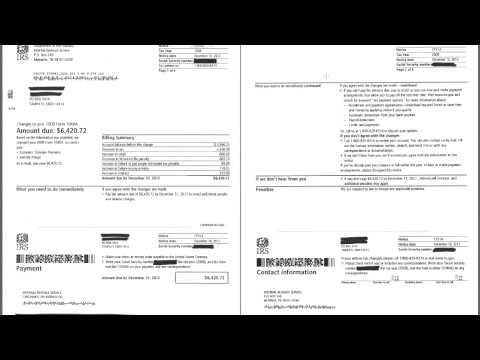

P>D p21 a is a form that you get from the IRS after you file or provide some information to the IRS. - You still owe as a result of that information. - It could also be that you didn't know before you provided that information, but you do owe now. - Bottom line, the CP 21 a is all about the fact that you still have a balance due. - It satisfies the notice and demand requirement of the IRS to go ahead and pay this. - Other than that, there's not too much consequence of it. - It's important to note that they cannot levy or seize your wages, bank accounts, or any other property based on a CP 21a. - That would require a letter 1058. - A CP 21a is essentially notice-and-demand that you owe taxes. - If you have other questions or would like more information about IRS problem resolution, please visit our website at get IRS help calm.

Award-winning PDF software

Video instructions and help with filling out and completing Form 944 Pr Veterans