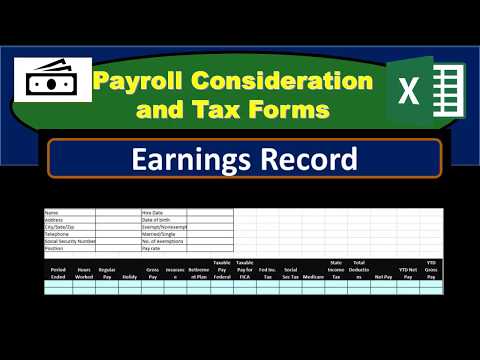

In this presentation, we will discuss payroll considerations and tax forms. For more accounting information and accounting courses, visit our website at accountinginstruction.info. We will begin by discussing payroll frequency, which refers to how often employees will be paid (i.e. weekly, monthly, bi-weekly). It is important for payroll professionals to be able to work with different types of employers and determine the best payroll frequency for each company. This decision will need to consider the size of the company and any specialized needs within the company. Another important consideration is the method of payment. Will the company use paper checks or direct deposits? The choice of payment method can vary greatly depending on the needs of different companies. Payroll professionals must be able to adapt and process payroll according to these different payment methods. As we work with payroll, we will encounter a variety of needs and characteristics specific to each company and industry. This can make us specialists in handling specific types of payroll processes. For example, we may need to deal with advances and establish policies for how to process and record them. Additionally, we will need to handle payroll benefits and determine the appropriate procedures for recording them. Tax compliance is a major complexity when it comes to payroll. We must ensure that we are recording and processing payroll correctly to comply with tax regulations. We have a heightened responsibility to pay payroll taxes because we are withholding money from employees. Failure to pay these taxes is not just a matter of not paying our own income taxes, but it can be seen as stealing from employees. Calculating payroll taxes requires precision. Unlike income taxes, payroll taxes must be calculated with great exactness. We need to be careful and ensure that we are in compliance with payroll tax regulations. The forms we...

Award-winning PDF software

Video instructions and help with filling out and completing Form 944 Pr Includes