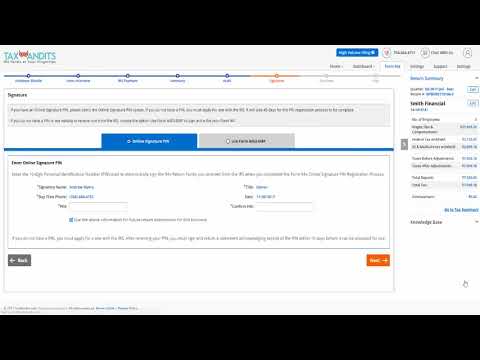

P>So now that you know, you can e-file form 941 with Text Bandits. Would you like to learn how to do so? Step 1: Log in to your Text Bandits account and click on form 941 under forms. If you just created your account, you'll bypass this step because you'll automatically be taken to the list of available forms. To get started, next it's time to fill in those employer details. You can either select from an existing employer in your account or add a new one. In addition to the details shown, you'll also provide the employer address, contact details, and signing authority. Now it's time to choose a tax filing order. As you can see, you can choose between the current tax year or the most recent previous one. So select the year from the drop-down, then click the start filing button in the quarter that corresponds with the quarter for which you need to file a form 941. Next, you'll fill in a series of fields and answer questions to provide your wage and tax information for the quarter. Don't worry, in these sections, Text Bandits won't let you keep moving forward if you enter something in the wrong order. You may even find that our streamlined process is more simple and straightforward than filling out those paper forms. Now that you've entered your information to complete your form 941, you'll have the option to pay any taxes currently due to the IRS before your deadline. You'll probably notice there's a summary of the information you've entered so far to the right of your screen. You can click the edit button in this section to go back and make any changes or click the go-to tax summary button to view more details about your form 941 taxes....

Award-winning PDF software

Video instructions and help with filling out and completing Form 944 Pr Historical