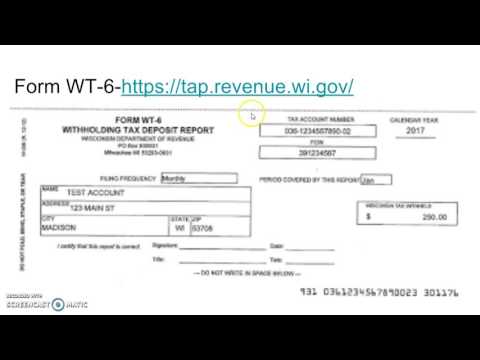

Once you're done paying your payroll taxes at the end of each quarter and annually, you will have to prepare some payroll tax forms just to make sure that you are paying the correct amount of taxes. The forms that we're going to look at are the W-3, W-2, the WT-6, 940, and the 941. So, anytime you have to make a 941 tax or a 940 tax, what we would do is write a check, fill out this coupon, and go in the Ovilus to the type of tax. I know it's hard to see, but this would be the 941. For a 940 tax, you would oval in what tax you're paying this for and what quarter it would be applied to, so the IRS can make sure that you're paying the correct amount of taxes. What we do now, instead of filling out the 80-109, is going online to EFTPS.gov, logging in, and having the money taken out electronically from your checking account. So, this would be for a 941 or 940 tax which is federal, not state. To make sure that you are paying the correct amount of federal income tax and Social Security and Medicare, you would have to fill out a 941 form and it is quarterly. So, every quarter, you want to make sure that you summarize what your wages were, as well as how much federal income tax you have withheld from your employees' paychecks, as well as Social Security and Medicare wages. For the 940 tax, that's for federal unemployment, not state. But federal, you would complete this form on an annual basis just to make sure that you are depositing the correct amount of federal unemployment to the IRS. This can also be done at EFTPS.gov, depositing the 940 tax....

Award-winning PDF software

Video instructions and help with filling out and completing Form 944 Pr Filers