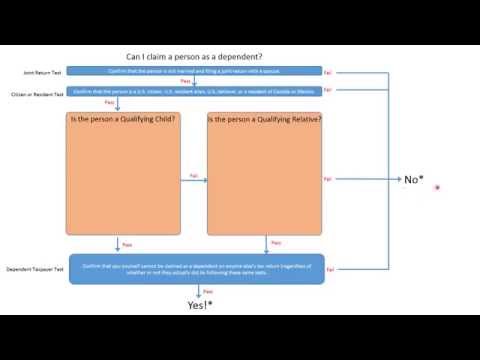

Hi everyone! I've created this quick video to clear up the IRS rules for claiming a dependent on your United States federal income tax return. If you're wondering whether you can claim a person as a dependent, you might feel a bit lost with all the rules. However, for most people, it boils down to a few simple questions which I present here. Note that you can also use this flow chart to determine if you can be claimed as a dependent by someone else, such as your parent. Just answer these questions from their perspective about yourself. Now, if you're trying to determine if you can claim a person as a dependent, first come two simple questions: the joint return test and the citizen or resident test. In order to claim someone as a dependent, that person cannot be married and filing a joint return with a spouse. They may be married and filing a single return, and that's okay, but they cannot be filing a joint return with a spouse. Next, the person you claim as a dependent has to be a US citizen, resident alien, national, or resident of Canada or Mexico. Then come the two main questions that usually trip people up: is the person a qualifying child? If not, they could still be a dependent if they are a qualifying relative. If one of those two is true, you go under the last test and they can be claimed as a dependent. If they are not a qualifying child or qualifying relative, they cannot be claimed as a dependent. The last test, as long as they're a qualifying child or relative, is the dependent taxpayer test. You just have to confirm that you yourself cannot be claimed as a dependent on anyone else's tax return...

Award-winning PDF software

Video instructions and help with filling out and completing Form 944 Pr Amended