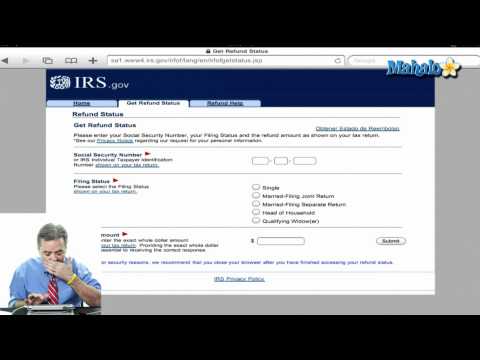

Okay, so let's get to the next question. Here, it looks like from EMV B, we can have, "How can I check my tax return status? My tax refund status, that is." Online, the good news is if you've already completed your tax return, maybe you sent that in three or four weeks ago, and what you were wondering is how to actually check that refund status. You can go straight to the IRS website. Let me show you here. As you go straight to the IRS website, if you go to the main homepage right here on IRS.gov, which is WWIRs.gov, right on the homepage, they'll show you exactly how to go check your refund status. See over here on the right-hand side of this form, "Where's my refund?" Click right on that refund status, piece of cake. If you go through here, here's the place here to click a hotspot right for, "Where's my refund?" Okay, let's go back a step. "Where's my refund?" You've got to have three pieces of information in order to check that refund status. The IRS is going to want you to put in your social security number. You'll need to put in the filing status on the tax return that you're checking that refund status. So, if you filed as a single taxpayer, married filing jointly, you've got to click that. Now, most importantly, is you've got to know exactly what refund you're expecting. So, you'll probably have a copy of your tax return with you. So, go to that tax return, look at the refund you're expecting, and you've got to put that in the here at the bottom of the form. Hit go. The IRS will come back, and they'll tell you whether it's been processed, whether it's been accepted,...

Award-winning PDF software

Video instructions and help with filling out and completing Are Form 944 Pr Refunds