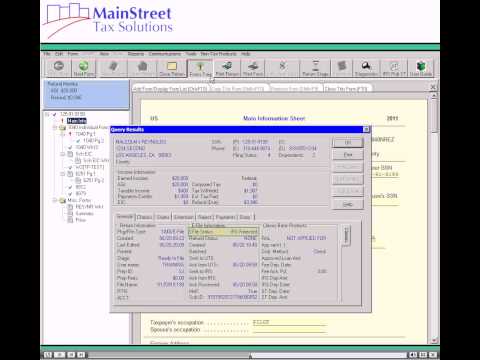

Hello and welcome to our software tutorial series. In this tutorial, you will learn how to fix and resend rejected returns in the tax software. The process involves correcting IRS e-file rejection errors and recreating e-file rejected returns. When a return is rejected, the IRS provides an error reject code and an associated sequence number. The sequence number indicates which entry on a given form caused the rejection. The printed reject also includes suggestions from the software on how to fix the error. For rejected returns sent using modernized e-file, a different system of codes known as business rules is used to provide detail on the cause of the rejection. Modernized e-file does not use sequence numbers but instead specifically describes the exact form location and nature of the error. If a reject is received for a return, it is important to print the IRS acknowledgment report to review the reject code, explanation, and suggestions for correcting the return. To correct a rejected return in the software, open the return from inside a return. You can also view a rejection explanation by pressing the F7 key or opening the Tools menu and selecting return status in the query results dialog. In the e-file information section, you can view the status of the e-file for returns that have been rejected by the IRS. Clicking on the reject tab will display the IRS reject code and an explanatory message for the first reject. In this example, there was a last name and taxpayer ID number mismatch rejection for the second dependent. To correct this, you need to change the dependent's taxpayer identification number on the main information sheet. When you make this change on the main information sheet, the data will carry over to any forms that the dependent is listed on. After making the...

Award-winning PDF software

Video instructions and help with filling out and completing Are Form 944 Pr Refund